Mitel Speaks on 'Elephants' and Contact CentersMitel Speaks on 'Elephants' and Contact Centers

No subject was off the table at last week's briefing with industry analysts.

November 18, 2014

No subject was off the table at last week's briefing with industry analysts.

At an intimate, two-day industry analyst gathering last week, key Mitel executives shared updates on everything from the company's progress on consolidating its contact center platforms to where it stands on the cloud. No subject was really off the table -- including the big elephant in the room, or Mitel's proposal to acquire ShoreTel.

Analysts, of course, were keen to discuss Mitel's acquisition plans, and CEO Rick McBee was happy to oblige, even to the point of including the slide, at right, in his presentation deck.

McBee discussed his studied approach to acquisitions and his belief that the combination not only would benefit ShoreTel shareholders and customers, but also was in line with needed industry consolidation. Mitel's strong financials (EBITDA of 12.7%) gave the company the wherewithal to attempt such a large acquisition so quickly on the heels of the Aastra Technologies buy, which closed in January, McBee said. In addition, McBee voiced his surprise that the ShoreTel board was unwilling to even discuss the proposal, a comment repeated in yesterday's announcement from Mitel that it had withdrawn its bid ahead of schedule (read Mitel Giving Up on ShoreTel Acquisition).

Even though Mitel placed the possible ShoreTel acquisition on the back burner for now, it still had plenty of interesting news to discuss on its strategic focus, which McBee describes in terms of "3+1." First is maximize value in the core, second is accelerate in cloud, and third is rapidly expand in contact center. The +1 is to overlay a vertical industry approach on all of the company's efforts.

I'll focus here on the contact center business, which has grown rapidly through acquisition over the last year. Mitel purchased long-time contact center OEM PrairieFyre in June 2013. In March 2014, it acquired call recording partner OAISYS and in May announced an OEM deal to resell LiveOps' cloud contact solution. To add even more complexity to the portfolio, the Aastra acquisition came with not only a number of call control platforms, but also several contact center solutions.

Chris Courneya, former PrairieFyre president who is now vice president and general manager for MiContact Center, opened his remarks at the analyst meeting by offering statistics on Mitel's success in the contact center. Over the past three years, Mitel has seen CAGR exceed 20% (31% in 2014) for its contact center business, sold 100,000 agent seats annually, and grown multichannel seat licenses by 56%, he said.

As outlined in the graphic below and discussed by Courneya, Mitel plans to consolidate all of its contact center platforms into a single application that's able to support any of the call control platforms in the company's portfolio. Courneya was quick to add that this is a multiyear process with the ultimate goal not only being a solution that supports all of Mitel's telephony platforms but also a contact center solution that is completely switch agnostic.

Mitel already has a solution that supports Microsoft Lync (soon to be Skype for Business). A platform-independent contact center solution will broaden Mitel's addressable market to any business.

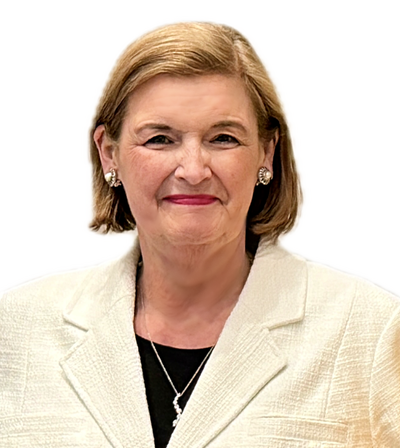

Follow Sheila McGee-Smith on Twitter and Google+!![]() @McGeeSmith

@McGeeSmith Sheila McGee-Smith on Google+

Sheila McGee-Smith on Google+